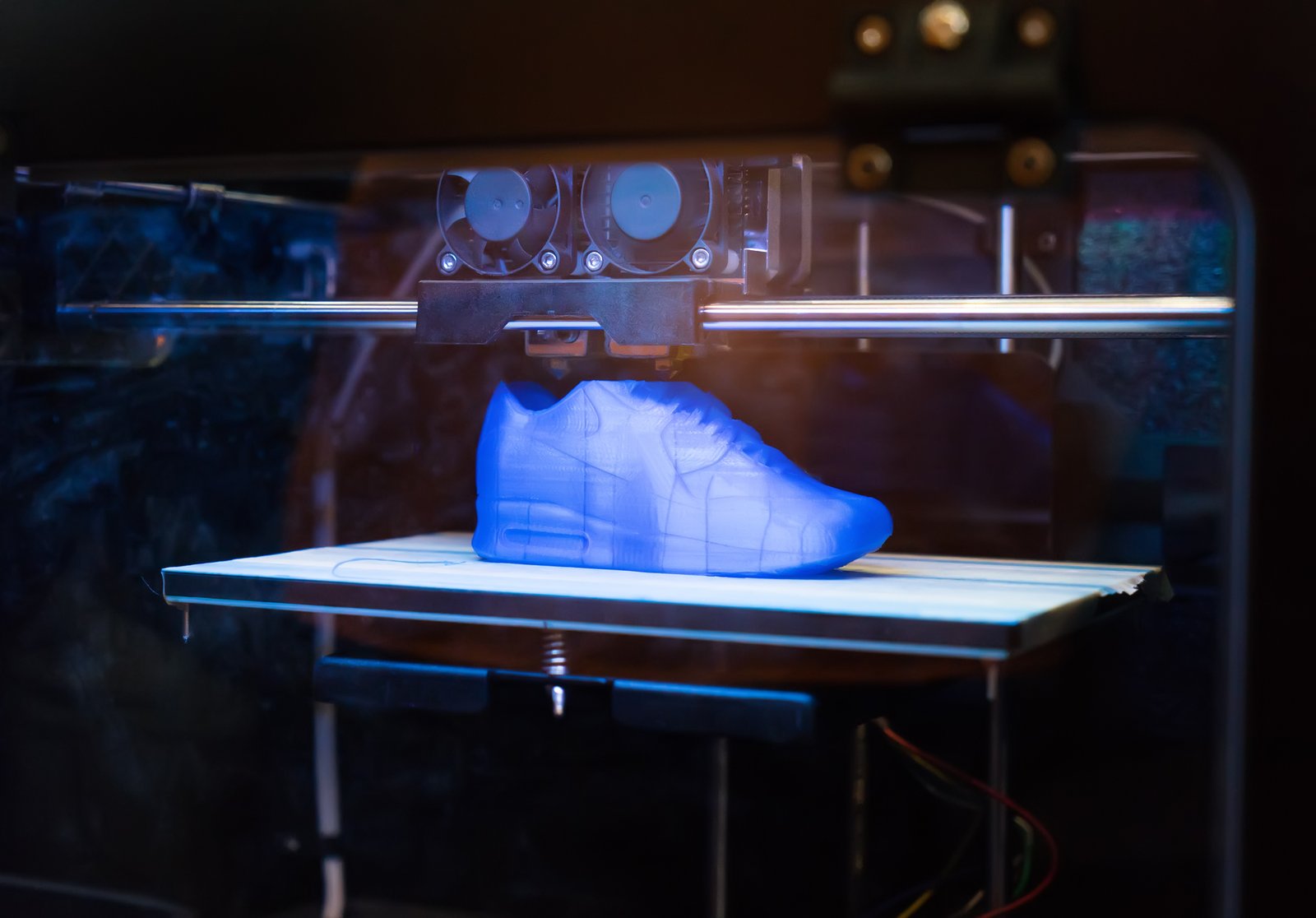

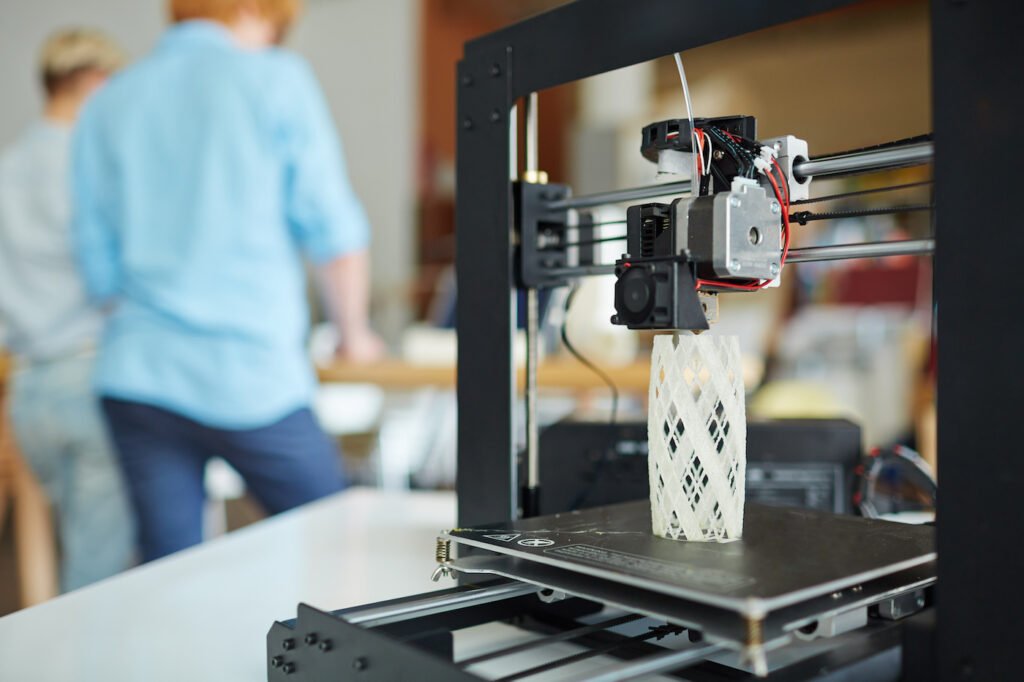

Recently, 3D printing has evolved from an idea that was once a fantasy to an everyday technology that is changing the face of industries such as aerospace, healthcare and automotive, construction, and even manufacturing. The more disruptive technology develops will the potential for investment in companies that are at the forefront of the revolution in 3D printing. If you’re hoping to capitalize on this trend, 5starsstocks.com 3D printing stocks can be a good starting point.

In this post, we’ll review the top 3D printing companies that you must keep an eye on, supported by trends in the market, income potential, and insights from experts — all collected by 5starsstocks.com to assist you in making better investment decisions.

🔍 What Makes 3D Printing Stocks So Attractive?

3D printing, also known as additive manufacturing, allows for the creation of complex parts with minimal waste, faster production times, and lower costs. This capability is transforming traditional supply chains and allowing industries to innovate in ways previously impossible.

The global 3D printing market is projected to reach over $70 billion by 2030, growing at a compound annual growth rate (CAGR) of more than 20%. That makes 5starsstocks.com 3D printing stocks an exciting space for long-term growth investors.

Whether you’re a beginner or an experienced investor, understanding where this industry is headed can open the door to new wealth-building opportunities.

📈 Top Growth 3D Printing Stocks to Watch

Here are some of the most promising companies in the 5starsstocks.com 3D printing stocks portfolio that are worth keeping an eye on:

1. Stratasys Ltd. (NASDAQ: SSYS)

Stratasys is one of the original pioneers in 3D printing. It provides 3D printing systems for prototyping and production in industries like aerospace, healthcare, and automotive. The company has been aggressively expanding its portfolio through strategic acquisitions and partnerships.

Why Watch SSYS?

- Broad product line targeting high-growth industries

- Strong R&D and innovation pipeline

- Revenue growth driven by healthcare and aerospace applications

As of 2025, analysts see Stratasys as a key player in the 5starsstocks.com 3D printing stocks category due to its aggressive push into industrial-scale manufacturing.

2. 3D Systems Corp. (NYSE: DDD)

Another founding name in 3D printing, 3D Systems offers both hardware and software solutions. Their services span industries such as dental, aerospace, defense, and medical.

Why Watch DDD?

- High-margin medical and dental segment

- Expanding international presence

- Focus on recurring revenue via software and services

For anyone following 5starsstocks.com 3D printing stocks, 3D Systems is often highlighted for its diversified revenue streams and strong intellectual property portfolio.

3. Desktop Metal Inc. (NYSE: DM)

A newer company with major innovation under its belt, Desktop Metal is focused on metal and industrial-grade 3D printing systems. It’s disrupting traditional metal part manufacturing.

Why Watch DM?

- Specializing in metal additive manufacturing

- Strong interest from the automotive and aerospace sectors

- Rapidly expanding customer base

5starsstocks.com 3D printing stocks feature Desktop Metal as a high-growth small-cap with potential upside if it captures more of the industrial metal market.

4. Proto Labs, Inc. (NYSE: PRLB)

Proto Labs takes a different approach by focusing on on-demand manufacturing services using 3D printing, CNC machining, and injection molding. They serve a wide range of small and mid-sized businesses.

Why Watch PRLB?

- End-to-end production platform

- Recurring client base in medical and consumer products

- Proven profitability and scalability

PRLB consistently ranks among 5starsstocks.com 3D printing stocks thanks to its sustainable business model and diversified service offerings.

5. Materialise NV (NASDAQ: MTLS)

Materialise, based in Belgium, is a global leader in 3D printing software and medical solutions. Its software tools are widely used by engineers, designers, and hospitals worldwide.

Why Watch MTLS?

- Leader in 3D printing software

- Stronghold in healthcare applications

- Strategic partnerships with big tech and biotech firms

Investors looking for strong fundamentals and international exposure within the 5starsstocks.com 3D printing stocks universe will appreciate Materialise’s unique business model.

🧠 What to Consider Before Investing

Before diving into 5starsstocks.com 3D printing stocks, here are some key factors to consider:

Volatility:

Many 3D printing stocks are small or mid-cap and can be volatile. Be prepared for sharp price swings.

Revenue Models:

Some companies make money through hardware sales, others via services, software, or recurring subscriptions. Diversified revenue is usually more stable.

Competition & Innovation:

The space is competitive and technology is evolving fast. Companies investing heavily in R&D tend to stay ahead.

Industry Adoption:

Some sectors adopt 3D printing faster than others. Healthcare and aerospace are leading, while consumer products and construction are catching up.

Regulatory Factors:

In sectors like healthcare and aerospace, compliance and certification can affect product rollout speed and profitability.

At 5starsstocks.com, each stock is analyzed based on these and many more indicators, helping you cut through noise and focus on high-potential investments.

📊 Sector Trends That Support 3D Printing Growth

Some macro trends driving the rise of 5starsstocks.com 3D printing stocks include:

- Decentralized manufacturing: Companies want more control over their production, and 3D printing enables local, on-demand manufacturing.

- Customization: Whether it’s custom medical implants or specialized parts, 3D printing allows for tailored solutions.

- Sustainability: Reduced waste and energy use make 3D printing a more eco-friendly option than traditional manufacturing.

- Post-COVID supply chain shifts: Businesses are rethinking global supply chains, and 3D printing helps reduce reliance on overseas production.

All of these trends suggest that 5starsstocks.com 3D printing stocks are not just a temporary hype—they’re foundational to the future of how products are made.

📌 Tips for New Investors in 3D Printing

If you’re only beginning to get started in the world of 5starsstocks.com 3D printing stock, these are some tips to consider:

- Start by investing a little, gradually increasing the amount of money you invest as you increase your confidence.

- Diversify: Spread your funds among several businesses instead of placing your bets on one company.

- Be informed: Keep track of the latest developments in tech, earnings, as well as industry news.

- Make use of platforms such as 5starsstocks.com. Use 5starsstocks.com to benefit from carefully curated stock recommendations, professional analysis, and monitoring tools specifically designed for investors.

Conclusion

Yes, if you’re investing with a longer-term perspective and are willing to take on some risk, the upside of 3D printing is huge. The businesses listed above have been at the forefront of this revolution and are an ideal choice for portfolios that are growing.

Manufacturing’s future is printing one layer at a time, and smart investors are profiting from. By utilizing the expert advice of 5starsstocks.com 3D printing stock, you’ll have the opportunity to stay ahead of the pack and reap the benefits of the sectors of the future.